Banking is the life blood of modern commerce. It has played a very important role in the economic development of all the countries of the world. We cannot think of modern commerce without banking.

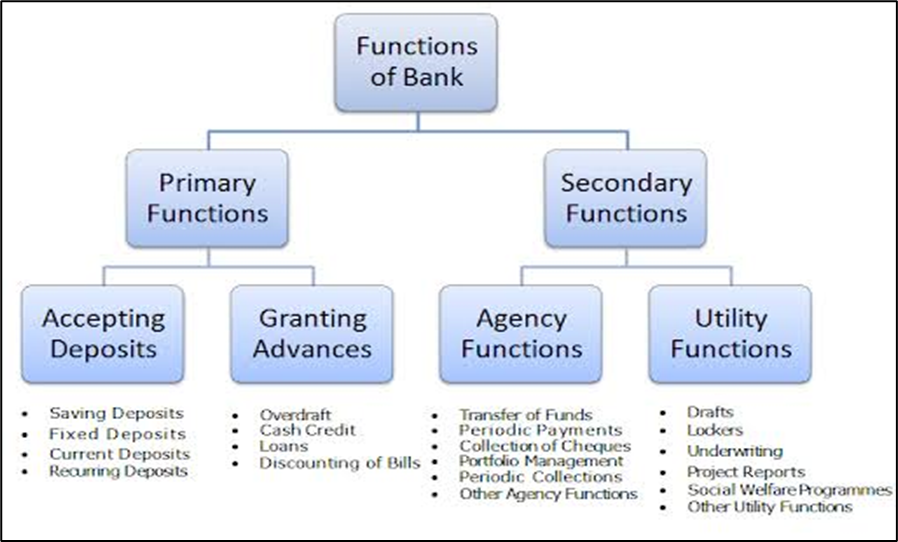

Figure 7.3 Basic Banking Functions

Banking is a business. Like any other business, banks are also profit-making organizations. Borrowing and lending constitute the banking business as these are the two basic functions of a bank. It should be noted that banking became out of the need of people for safe place of deposits. Later, banks realized that their business could be made profitable if the money they received was re-lent. Gradually, banks started providing many other services to the people. These are other tasks a modern banker performs. All these functions and services can be classified under primary functions and secondary functions.

Basic functions- The entire banking functionality is divided under the following: (i) Primary Functions (ii) Secondary Functions.

Primary Functions-

Primary functions include accepting deposits, granting loans, advances, cash, credit, overdraft and discounting of bills. Some of the primary functions of banks are discussed below

[1] Accepting Deposits- The most important activity of a commercial bank is to raise deposits from the public. Those who have surplus income and savings, find it convenient to deposit the amount with the banks.

Depending on the nature of the deposit, the money deposited with the bank also earns interest. Thus, deposits with the bank increase with accrued interest. If the rate of interest is high, the public is motivated to deposit more money with the bank. The bank also has the security of deposited funds. Banks are also called custodians of public money. Originally, money is accepted as a deposit to keep it safe, but since banks use this money to learn interest from people who need money, they share a portion of this interest with depositors. The amount of interest depends on the tenure - the time for which the depositor wants to keep the money with the bank - and the ease of withdrawal. The rule of thumb is: the longer the tenure, the higher the rate of interest, and the lower the ban on withdrawals, the lower the interest. Banks can accept the deposits from various sources like:

• Saving deposits

• Fixed deposits

• Current deposits &

• Recurring deposits

[2] Granting Advances/Loans

Another important feature of bank is the granting of loans and advances to their customers. Some types of Advances/Loans are:

• Overdraft

• Cash Credits

• Loans

• Bill Exchanges

Secondary Functions-

Secondary functions include issuing letter of credit, undertaking safe custody of valuables, providing consumer finance, educational loans, etc. Some basic secondary functions of banks are:

• Transfer of Funds from one location to another.

• Collection of Cheques from customers.

• Periodic maintenance of customer data.

• Periodic collections from other sources.

In addition to all above tasks bank has also performs some utility tasks like:

• Issue of Demand Draft and Letter of credits

• Locker facility for customer

• Accounting services for their customers

• Dealing with foreign exchange

• Various social welfare programmes.